divergence software, inc.

Development & Consulting Services

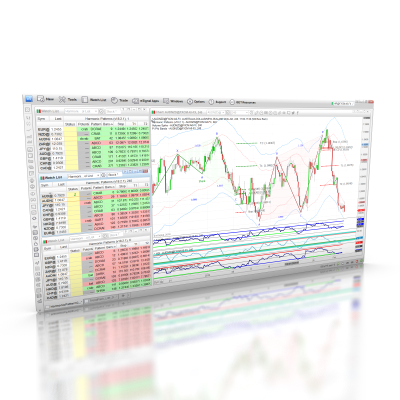

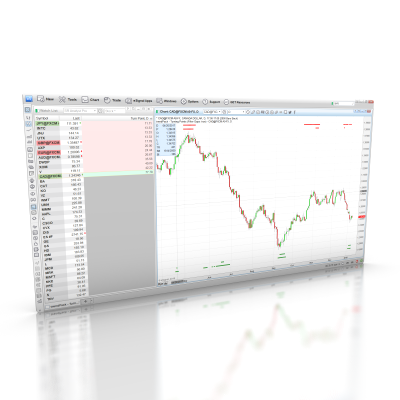

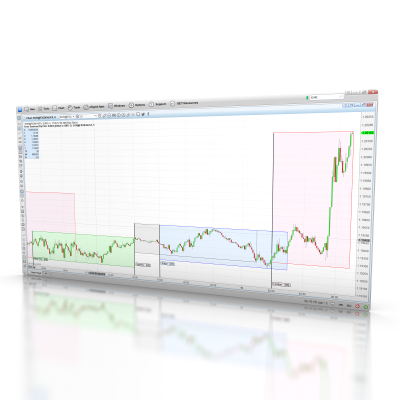

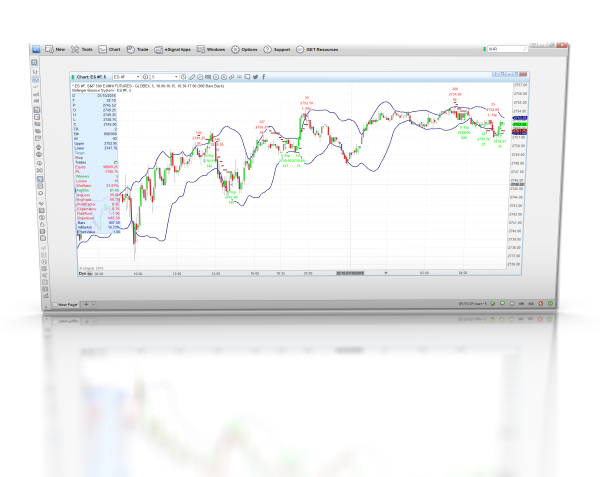

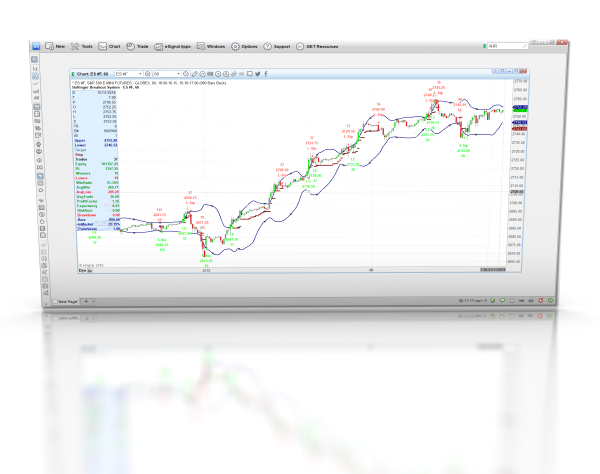

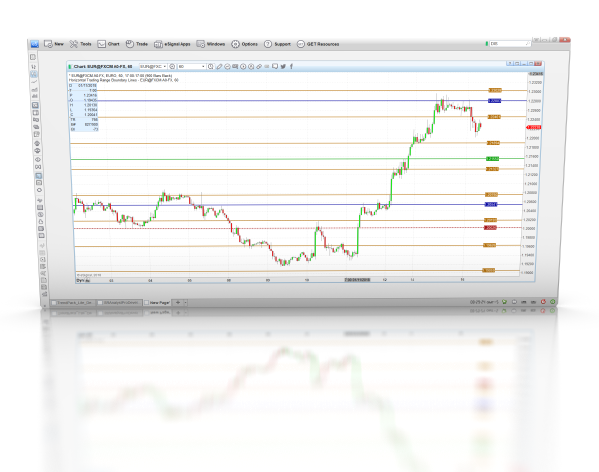

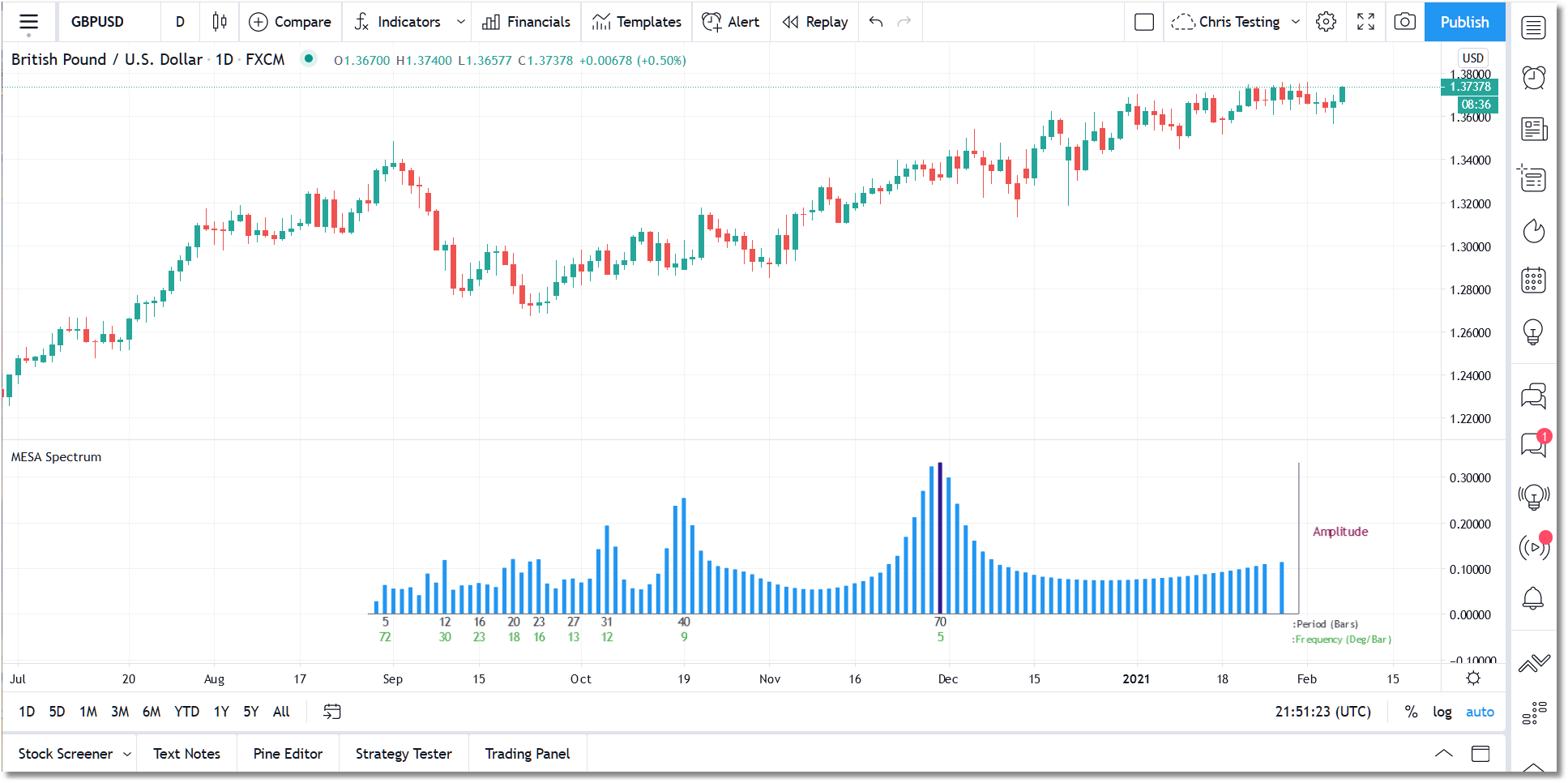

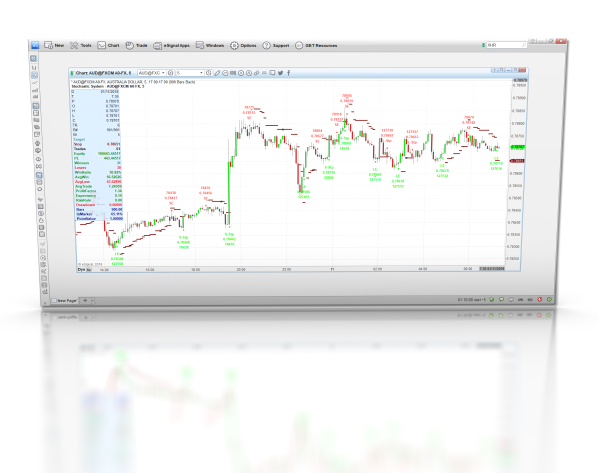

Products/Software

Divergence Software, Inc. has created a number of eSignal EFS studies (and some TradingView and MetaTrader 4 studies) that can be purchased individually. All of the available studies are listed below (use the Categories control below to select an indicator Category and navigate through the available studies).

To purchase a study or a package, simply click on the appropriate Add to Cart button and that item will be added to your online shopping cart. When you have finished selecting items, click on the Checkout button on the Shopping Cart page and you will be taken to a secure server where you can complete the transaction. All prices are USD.

Unless otherwise specified in the study description, all prices are a one-time-fee (i.e., non-recurring).

If you subscribe to our mailing list, please check your InBox for our most recent mailing as it contains discount codes that can be applied to all products in our catalog. If you are not a subscriber, then sign up today to receive periodic discount offers that are only available to list members.

If you would like a trial run of any of our indicators, just send an email to the support address on our Contacts page. Tell us which indicator you would like to try and please include your eSignal program username (case sensitive) so that we can set up the trial for you. Please note that trials may not be available for all indicators.

Once the credit card transaction has been completed, the eSignal studies or package you have purchased will be delivered to you as an email attachment. We will generally deliver the product to you within minutes of your order, but please allow 48 hours. Certain scripts require a username for activation purposes and we cannot deliver these scripts until we receive your eSignal program Username (via email is fine). In the unlikely event that you do not receive your order within 48 hours, please send an email message to support@sr-analyst.com.

For TradingView indicator purchases, there is no delivery or installation required, we will simply activate the indicators for your account once you have provided us with your TradingView Username.

Please note that eSignal and TradingView program Usernames are case-sensitive.

While some of the studies in our catalog do come with complete source code, most studies do not. This is clearly displayed in the description of each indicator/study.

Join our mailing list and periodically you will receive valuable discount codes that are only available to our list subscribers. We will also keep you apprised of our latest product offerings.

Sign Up!