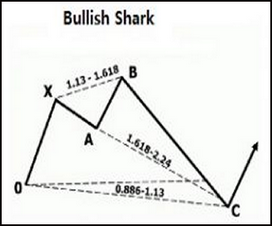

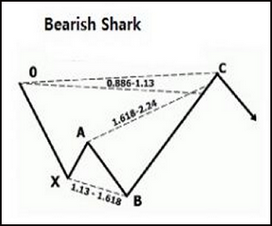

The Shark pattern is a 4-leg pattern and it is essentially an emerging 5-0 pattern. In a perfect Shark pattern the AB leg should be a 1.130 to 1.618 extension of the XA leg, and the BC leg should be a 1.618 to 2.240 extension of the AB leg, and the C point should be a 0.886 to 1.130 retracement/extension of the OX leg.

The Shark pattern will always begin as an AB=CD pattern. When the specific ratios are met, it will be redrawn as a Shark, and it may eventually evolve into a 5-0 pattern. All 5-0 patterns start out as Shark patterns, but not all Shark patterns will evolve into a 5-0 pattern.

The Shark pattern can be toggled on or off by checking/unchecking the Show Shark? checkbox in the parameters dialog.

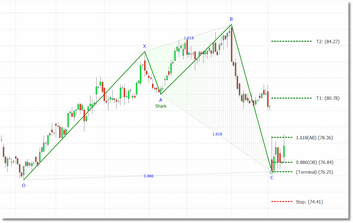

Here are some example Shark patterns found in eSignal:

The Terminal Bar is the price bar that reaches the minimum pattern completion requirements and will always be identified by the ☼ symbol. You can adjust the size via the Terminal Bar Font Size option in Settings.

|

Scott Carney at HarmonicTrader.com has put together a PDF that explains the Shark pattern in detail, which you can view here. |

See Also: