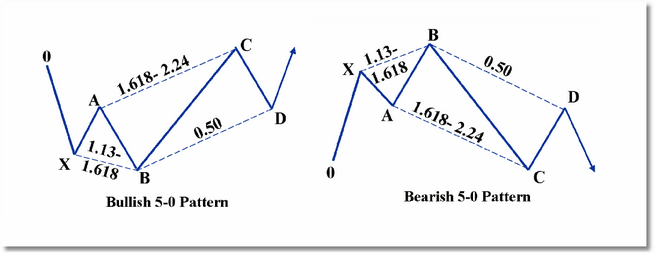

The 5-0 Pattern is a unique structure that possesses a precise alignment of Fibonacci ratios to validate the pattern. Although the 5-0 is considered a retracement pattern, as the 50% retracement is the most critical number within the Potential Reversal Zone, the measurements of the various price legs are slightly different than the Bat or the Gartley.

The 5-0 is within the family of 5-point harmonic reversal structures and is primarily defined by the structure’s B point – as is mandatory for all harmonic patterns. However, the 5-0 requires a reciprocal AB=CD measurement to define the pattern’s completion. The basic premise of the pattern is to identify distinct reactions following the completion of a contrary trend.

Valid 5-0 patterns typically represent the first pullback of a significant trend reversal. In many instances, the AB leg of the structure is a failed final wave of an extended trend.

The 5-0 pattern can be toggled on or off by checking/unchecking the Show 5-0? checkbox in the parameters dialog. All 5-0 patterns start out as Shark patterns, but not all Shark patterns will evolve into a 5-0 pattern.

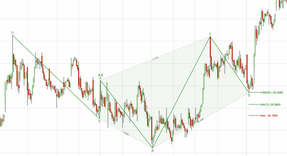

Here are some example 5-0 patterns found in Technician:

See Also: