The general extension structure of the Butterfly pattern was discovered by Bryce Gilmore. However, the exact alignment of ratios was defined in Scott Carney's 1998 book, "The Harmonic Trader." This has become the industry standard for the structure.

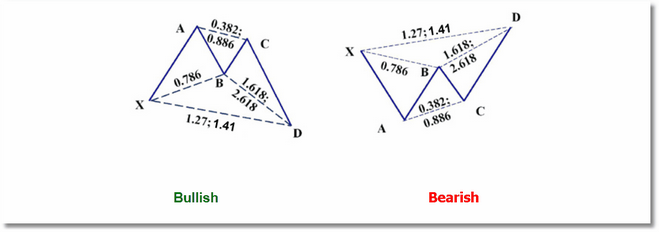

Scott's ideal Butterfly Pattern requires specific Fibonacci ratios to validate the structure. These measurements include a mandatory 0.786 retracement of the XA leg at the B point, which defines a more precise Potential Reversal Zone (PRZ) and more significant trading opportunities. Also, the Butterfly pattern must include an AB=CD pattern to be a valid signal.

Frequently, the AB=CD pattern will possess an extended CD leg that is 1.27 or 1.618 of the AB leg. Although this is an important requirement for a valid trade signal, the most critical number in the pattern is the 1.27 XA leg. The XA calculation is usually complemented by an extreme (2.00, 2.24, 2.618) BC projection. These numbers create a specific Potential Reversal Zone (PRZ) that can yield powerful reversals, especially when the pattern is in all-time (new highs/new lows) price levels.

The Butterfly pattern can be toggled on or off by checking/unchecking the Show Butterfly? checkbox in the parameters dialog.

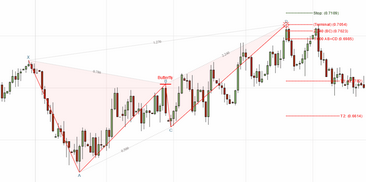

Here are some example Butterfly patterns found in Technician:

The Terminal Bar is the price bar that reaches the minimum pattern completion requirements and will always be identified by the ☼ symbol.

See Also: