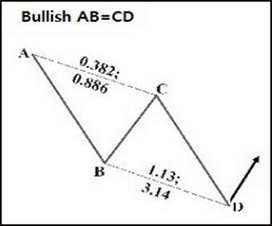

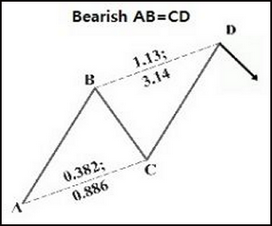

The AB=CD pattern is a price structure where each price leg is equivalent. The Fibonacci numbers in the pattern must occur at specific points. In an ideal AB=CD pattern, the C point must retrace to either a 0.618 or 0.786. This retracement sets up the BC projection that should converge at the completion of the AB=CD and be either a 1.27 or 1.618. It is important to note that a 0.618 retracement at the C point will result in a 1.618 BC projection. A 0.786 retracement at the C point will result in a 1.27 projection.

The most important consideration to remember is that the BC projection should converge closely with the completion of the AB=CD. The AB=CD is the cornerstone of all of the harmonic patterns.

The AB=CD pattern can be toggled on or off by checking/unchecking the Show ABCD? checkbox in the parameters dialog.

Here are some example AB=CD patterns found in eSignal:

The Terminal Bar is the price bar that reaches the minimum pattern completion requirements and will always be identified by the ☼ symbol. You can adjust the size via the Terminal Bar Font Size option in Settings.

See Also: